Acquisition will augment HouseCanary’s offerings for Investor clients

SAN FRANCISCO–(BUSINESS WIRE)–Home valuation fintech pioneer HouseCanary today announced it has acquired Dropmodel, a technology startup with analytic and financial modeling solutions for the single-family real estate asset class. In addition, Dropmodel Co-Founder Tom Blake has joined the company as Vice President of Investor Platform. This is the first acquisition for HouseCanary which recently closed a $65M Series C growth funding round.

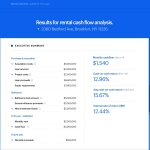

Dropmodel is a web-based real estate financial modeling, analysis, and presentation application that includes a suite of smart, flexible models, calculators, and tools for the single-family real estate sector. It helps single-family real estate investors — across all strategies — “drop” their data into analytical models and get instant, comprehensive results that support data-driven business decisions. Dropmodel was founded in 2017 and received early investment from Palo Alto based venture capital firm Social Capital, known for successful investments in Slack, Box, SurveyMonkey and other notable Silicon Valley success stories.

As a 50-state brokerage, HouseCanary helps investors buy and sell up to $200M of properties each month. This acquisition will augment HouseCanary’s offerings providing investors with programmatic capabilities to buy smarter.

“We are excited about our acquisition of Dropmodel and how it will enhance our product offerings,” said Jeremy Sicklick, Co-Founder and CEO of HouseCanary. “Dropmodel will add speed and clarity to our clients’ workflows to allow them to make investment and underwriting decisions faster and with more confidence. This is important today and, in the future, as our clients work with us to understand how market changes impact their business.”

“HouseCanary’s acquisition of Dropmodel will support the company’s continued expansion into the investment side of the single-family residential industry,” said Tom Blake, VP of Investor Platform at HouseCanary and co-founder of Dropmodel. “By integrating Dropmodel into our product roadmap, we’ll be able to leverage HouseCanary’s best-in-class data and valuation capabilities to unlock innovative solutions that drive better outcomes for our clients.”

By combining HouseCanary’s proprietary data with Dropmodel’s modeling analysis the company will provide new insights and significant benefits to investors across all phases of acquisition and ownership, including solutions for determining acquisition parameters, creating discounted cash flow projections, and asset management decisions. Terms of the acquisition are not disclosed.

About HouseCanary:

Founded in 2013, valuation-focused real estate brokerage HouseCanary provides software and services to reshape the real estate marketplace. Financial institutions, investors, lenders, mortgage investors, appraisal management companies, and consumers turn to HouseCanary for industry-leading valuations, forecasts, and transaction-support tools. These clients trust HouseCanary to fuel acquisition, underwriting, portfolio management, and more. Learn more at www.housecanary.com.

Contacts

Denise Dunckel

press@housecanary.com