By FocusEconomics

- Emerging markets suffer a weak first half

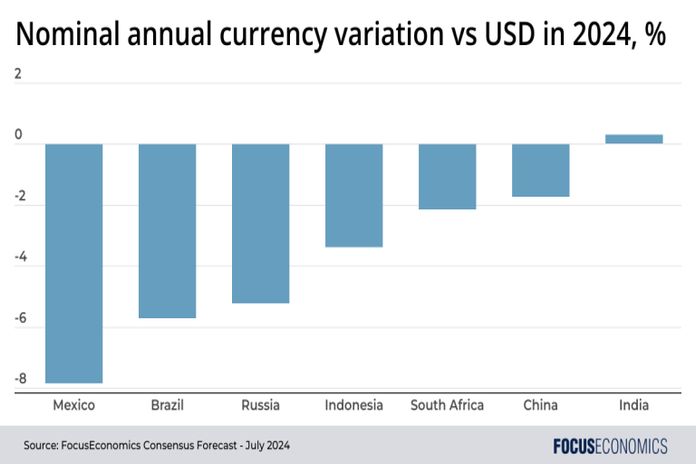

ASIA – In January–June, most emerging market currencies lost ground against the US dollar. This was in part due to market analysts paring back expectations of Federal Reserve rate cuts: Our Consensus Forecast for the end-2024 US policy rate rose from around 4.5 percent in late December to 5.1 percent by mid-June, as the US economy remained surprisingly robust and inflation stayed stubbornly above the Fed’s target. Rate cuts in emerging markets also played a role in the depreciation of emerging market currencies seen in January–June, as did sociopolitical uncertainty; in Mexico, for instance, a landslide victory for the incumbent administration sparked investor fears over constitutional reforms, while fiscal concerns in Brazil saw the real tumble.

Some economies buck the trend

That said, a few key emerging markets saw their currencies appreciate in January–June. South Africa’s rand strengthened in June as the country formed a moderate coalition government following elections. Russia’s ruble gained ground amid higher oil prices. And Kenya’s shilling appreciated by over a fifth from January to June thanks to a successful foreign-debt issuance plus financial support from the IMF and World Bank.

Our consensus forecast for exchange rates

Our Consensus Forecast is for virtually all emerging market currencies to be weaker against the US dollar in annual terms at end-2024. Notable exceptions will be India – thanks to high interest rates, currency intervention and strong investor interest – Kenya and Sri Lanka, where balance of payments pressures are fading. The longer-term outlook is region-dependent; exchange rates across Asia should be fairly stable from 2025 to 2028, buoyed by low inflation and strong export growth. In contrast, exchange rates in Latin America and Sub-Saharan Africa will stay on a persistent depreciatory trend amid sociopolitical instability and as inflation outpaces that in the US.

Insight from our analyst network

On the implications for emerging market currencies of a hike in US tariffs under a Trump presidency, Goldman Sachs analysts said:

“While tariffs and trade tensions are negative for EM FX in general with few winners, across a range of analytical exercises, the South African rand and Korean won tend to underperform markedly, with both currencies exposed to global risk sentiment and China (growth and market) downside. China may be a direct target of tariffs, but a key uncertainty is the degree to which policymakers allow CNY to adjust. Likewise, Mexico with its large export exposure to the US may or may not be protected by the USMCA agreement.”

Oxford Economics’ Jee-A van der Linde commented on South Africa’s rand:

“The rand exchange rate is very volatile and sensitive to global events. From a domestic perspective, this volatility is driven by policy uncertainties, a fragile fiscal position in light of contingent liabilities related to Eskom and other SOEs, weak credit ratings, and notable growth underperformance. […] In addition, the inflation differential with the US will tend to drive down the rand against the dollar in the long term. In the short term, we expect the [currency] will normalise as market exuberance fades.”

Our latest analysis

- Find out more about how falling inflation led Romania’s Central Bank to cut rates in July.

- Germany’s industrial sector weakened in May, and undershot market expectations.