- The US dollar continues to cede ground to nontraditional currencies in global foreign exchange reserves, but it remains the preeminent reserve currency

By Serkan Arslanalp, Barry Eichengreen , Chima Simpson-Bell

Dollar dominance—the outsized role of the US dollar in the world economy—has been brought into focus recently as the robustness of the US economy, tighter monetary policy and heightened geopolitical risk have contributed to a higher greenback valuation. At the same time, economic fragmentation and the potential reorganization of global economic and financial activity into separate, nonoverlapping blocs could encourage some countries to use and hold other international and reserve currencies.

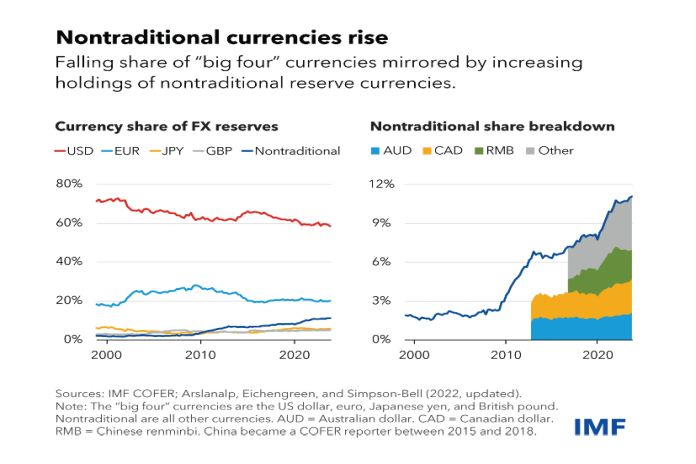

Recent data from the IMF’s Currency Composition of Official Foreign Exchange Reserves (COFER) point to an ongoing gradual decline in the dollar’s share of allocated foreign reserves of central banks and governments. Strikingly, the reduced role of the US dollar over the last two decades has not been matched by increases in the shares of the other “big four” currencies—the euro, yen, and pound. Rather, it has been accompanied by a rise in the share of what we have called nontraditional reserve currencies, including the Australian dollar, Canadian dollar, Chinese renminbi, South Korean won, Singaporean dollar, and the Nordic currencies. The most recent data extend this trend, which we had pointed out in an earlier IMF paper and blog.

These nontraditional reserve currencies are attractive to reserve managers because they provide diversification and relatively attractive yields, and because they have become increasingly easy to buy, sell and hold with the development of new digital financial technologies (such as automatic market-making and automated liquidity management systems).

This recent trend is all the more striking given the dollar’s strength, which indicates that private investors have moved into dollar-denominated assets. Or so it would appear from the change in relative prices. At the same time, this observation is a reminder that exchange rate fluctuations can have an independent impact on the currency composition of central bank reserve portfolios.

Changes in the relative values of different government securities, reflecting movements in interest rates, can similarly have an impact, although this effect will tend to be smaller, insofar as major currency bond yields generally move together. In any event, these valuation effects only reinforce the overall trend. Taking a longer view, over the last two decades, the fact that the value of the US dollar has been broadly unchanged, while the US dollar’s share of global reserves has declined, indicates that central banks have indeed been shifting gradually away from the dollar.

At the same time, statistical tests do not indicate an accelerating decline in the dollar’s reserve share, contrary to claims that US financial sanctions have accelerated movement away from the greenback. To be sure, it is possible, as some have argued, that the same countries that are seeking to move away from holding dollars for geopolitical reasons do not report information on the composition of their reserve portfolios to COFER. Note, however, that the 149 reporting economies make up as much as 93 percent of global FX reserves. In other words, non-reporters are only a very small share of global reserves.

One nontraditional reserve currency gaining market share is the Chinese renminbi, whose gains match a quarter of the decline in the dollar’s share. The Chinese government has been advancing policies on multiple fronts to promote renminbi internationalization, including the development of a cross-border payment system, the extension of swap lines, and piloting a central bank digital currency.

It is thus interesting to note that renminbi internationalization, at least as measured by the currency’s reserve share, shows signs of stalling out. The most recent data do not show a further increase in the renminbi’s currency share: some observers may suspect that depreciation of the renminbi exchange rate in recent quarters has disguised increases in renminbi reserve holdings. However, even adjusting for exchange rate changes confirms that the renminbi share of reserves has declined since 2022.

Some have suggested that what we have characterized as an ongoing decline in dollar holdings and rise in the reserve share of nontraditional currencies in fact reflects the behavior of a handful of large reserve holders. Russia has geopolitical reasons to be cautious about holding dollars, while Switzerland, which accumulated reserves over the last decade, has reason to hold a large fraction of its reserves in euros, the Euro Area being its geographical neighbor and most important trading partner. But when we exclude Russia and Switzerland from the COFER aggregate, using data published by their central banks from 2007 to 2021, we find little change in the overall trend.

In fact, this movement is quite broad. In our 2022 paper, we identified 46 “active diversifiers,” defined as countries with a share of foreign exchange reserves in nontraditional currencies of at least 5 percent at the end of 2020. These include major advanced economies and emerging markets, including most of the Group of Twenty (G20) economies. By 2023, at least three more countries (Israel, Netherlands, Seychelles) have joined this list.

We also found that financial sanctions, when imposed in the past, induced central banks to shift their reserve portfolios modestly away from currencies, which are at risk of being frozen and redeployed, in favor of gold, which can be warehoused in the country and thus is free of sanctions risk. That work also showed that the demand for gold by central banks responded positively to global economic policy uncertainty and global geopolitical risk. These factors may lie behind the further accumulation of gold by a number of emerging market central banks. Before making too much of this trend, however, it is important to recall that gold as a share of reserves still remains historically low.

In sum, the international monetary and reserve system continues to evolve. The patterns we highlighted earlier—very gradual movement away from dollar dominance, and a rising role for the nontraditional currencies of small, open, well-managed economies, enabled by new digital trading technologies—remain intact.

![]()