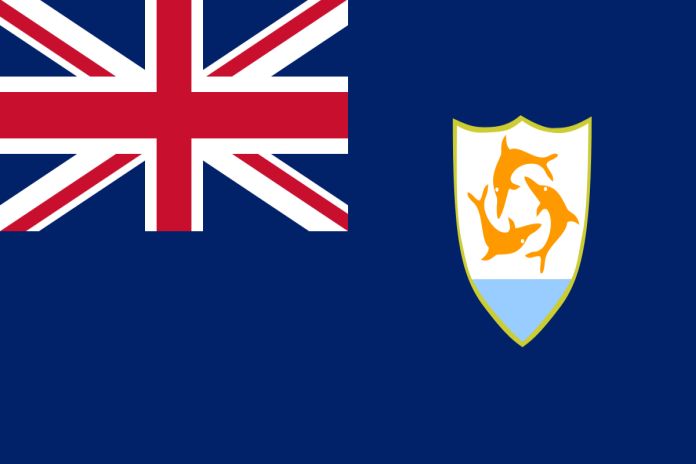

THE VALLEY, Anguilla – Caribbean Information and Credit Rating Services Limited (CariCRIS) has reaffirmed the assigned ratings of CariBBB+ (Foreign and Local Currency) to the national debt of USD$ 25 million of the Government of Anguilla (GoA). These ratings include a significant uplift for the high likelihood of support from the United Kingdom (UK).

The notched-up regional scale ratings indicate that the level of creditworthiness of this obligation, adjudged in relation to other obligations in the Caribbean is adequate.

CariCRIS has also assigned a stable outlook on the ratings. The stable outlook is based on the strong fiscal and debt management support from the United Kingdom, notwithstanding the uncertainty of the impact of the coronavirus (COVID-19) pandemic on the tourism industry and broader economic activity.

The ratings continue to be buttressed by the country’s status as a British Overseas Territory and as such, CariCRIS believes there likely will be strong support from the UK Government in the event of financial distress.

Also supporting the ratings is the significant headway made to rebuilding the economy and infrastructure following the passage of Hurricane Irma, and fiscal performance remains closely and carefully managed, notwithstanding the COVID-19 related expenditure.

Constraining the ratings, however, are: (1) the small size of the country along with significant capacity constraints, which will be compounded by the negative impacts of COVID-19, (2) the territory’s continued breach of its debt management performance benchmarks and increased debt servicing requirements, and (3) the stressed conditions in the financial sector.