By BDC

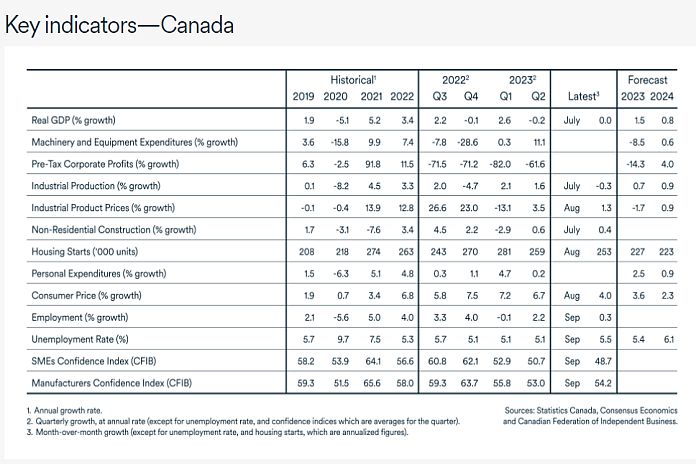

MONTREAL, Canada – The Bank of Canada maintained the status quo on Wednesday, October 25, 2023. The key rate will therefore remain at 5.0 percent. With more than half of the year behind us, the Bank acknowledged that the economy has been losing momentum. It stated that consumption has been stalling, as demand for durable goods, housing and services decreased since the beginning of the year. The bank revised its growth forecast lower for 2023, from 1.8 percent, to 1.2 percent; and for 2024, from 1.2 to 0.9 percent.

On the inflation side, the bank highlighted that the progress has been slower due to higher energy prices and elevated inflation expectations. Additionally, structural factors in the housing market are playing a role in keeping shelter inflation elevated. Although the bank did not hike rates further this time, it did mention that any upside risk to inflation would force it to raise rates again. At this stage, it has become quite clear that the Bank will need to keep rates higher for longer.

Bond yields, what are they good for?

Surging long-term bond yields have been tightening financial conditions significantly in recent months, leading to higher borrowing costs for households and businesses. In fact, Canada’s 5-year yield reached its highest levels so far this fall, hovering between 4.3 and 3.9 percent in recent months. These rates will be reflected on the 5-year fixed mortgage rates, directly affecting renewals this month, which will mean more pain for homeowners. While the Bank of Canada is waiting out the full impact of rate hikes, rising bond yields have given the Bank of Canada further incentive to pause on rate hikes.

The loonie continues its slide

The Canadian dollar depreciated even further, averaging US$0.73 in October and getting closer to US$0.72 since mid-October. The Canadian dollar’s slide against the US greenback is partly explained by the interest rate differential between the two countries. The exceptional resilience of the US economy has been fuelling the rate hikes debate, as well as giving a strong push to the USD against US trading partners’ currencies. The Canadian dollar is likely to remain weak, fluctuating between US$0.73 and US$0.72 over the coming months.

Pessimism intensifies among business leaders

CFIB’s business confidence index for the year ahead fell below the critical 50 mark – from 54.6 to 47.2 between August and October. Among provinces, confidence was lowest in Alberta, Ontario and Quebec, at 47.9, 46.5 and 46.1, respectively. Growing pessimism among businesses is not a surprise, given the economic slowdown and the tightening of credit conditions.