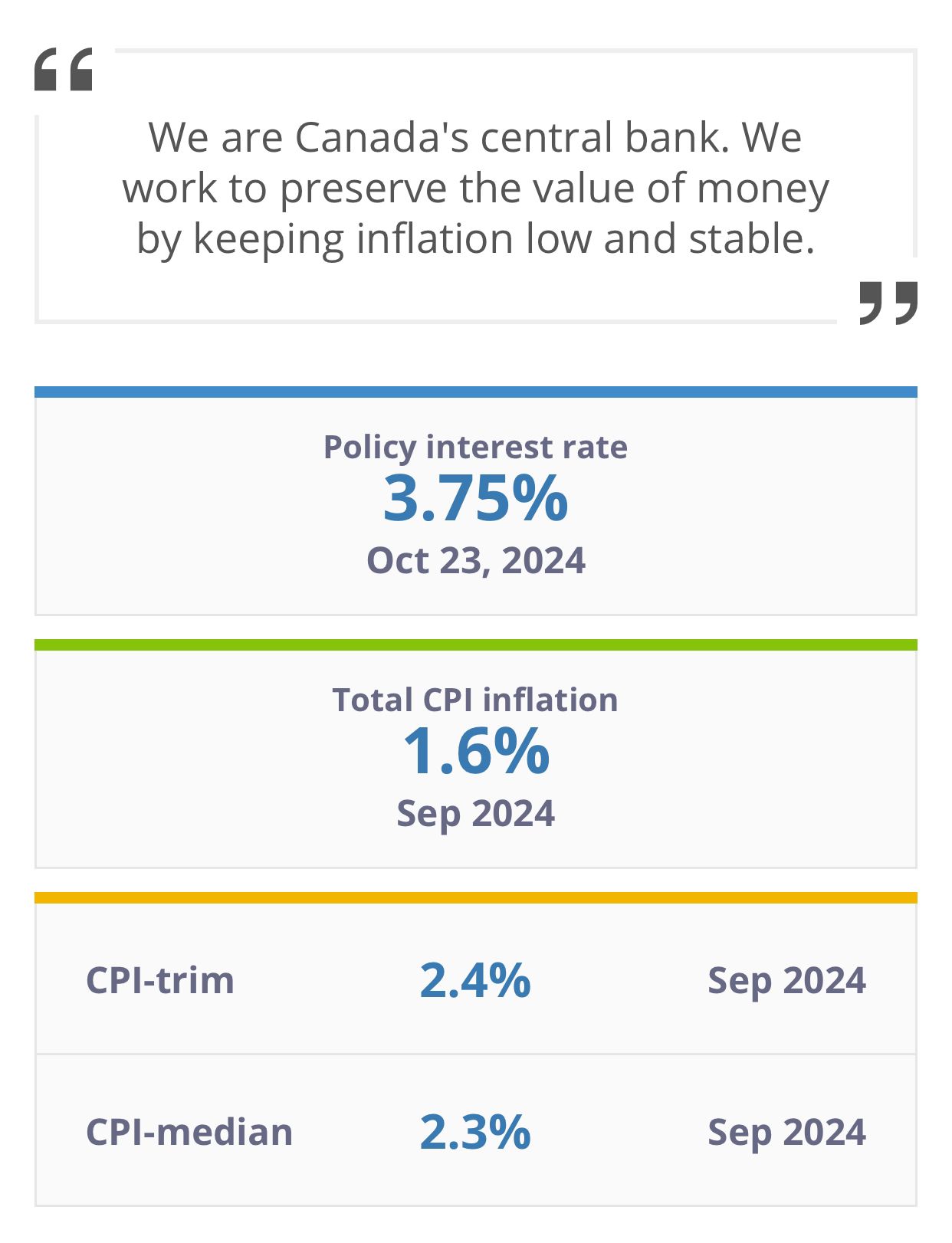

TORONTO, Canada – The Bank of Canada today reduced its target for the overnight rate to 3¾ percent, with the bank rate at 4 percent and the deposit rate at 3¾ percent.

The bank is continuing its policy of balance sheet normalization. The bank continues to expect the global economy to expand at a rate of about 3 percent over the next two years.

Growth in the United States is now expected to be stronger than previously forecast while the outlook for China remains subdued. Growth in the euro area has been soft but should recover modestly next year. Inflation in advanced economies has declined in recent months, and is now around central bank targets. Global financial conditions have eased since July, in part because of market expectations of lower policy interest rates. Global oil prices are about $10 lower than assumed in the July Monetary Policy Report (MPR).

In Canada, the economy grew at around 2 percent in the first half of the year and we expect growth of 1¾ percent in the second half. Consumption has continued to grow but is declining on a per-person basis. Exports have been boosted by the opening of the Trans Mountain Expansion pipeline. The labour market remains soft – the unemployment rate was at 6.5 percent in September. Population growth has continued to expand the labour force while hiring has been modest. This has particularly affected young people and newcomers to Canada. Wage growth remains elevated relative to productivity growth.

Overall, the economy continues to be in excess supply.

GDP growth is forecast to strengthen gradually over the projection horizon, supported by lower interest rates. This forecast largely reflects the net effect of a gradual pick-up in consumer spending per person and slower population growth. Residential investment growth is also projected to rise as strong demand for housing lifts sales and spending on renovations. Business investment is expected to strengthen as demand picks up, and exports should remain strong, supported by robust demand from the United States.

Overall, the bank forecasts GDP growth of 1.2 percent in 2024, 2.1 percent in 2025, and 2.3 percent in 2026. As the economy strengthens, excess supply is gradually absorbed.

CPI inflation has declined significantly from 2.7 percent in June to 1.6 percent in September. Inflation in shelter costs remains elevated but has begun to ease. Excess supply elsewhere in the economy has reduced inflation in the prices of many goods and services. The drop in global oil prices has led to lower gasoline prices.

These factors have all combined to bring inflation down. The bank’s preferred measures of core inflation are now below 2½ percent. With inflationary pressures no longer broad-based, business and consumer inflation expectations have largely normalized.

The bank expects inflation to remain close to the target over the projection horizon, with the upward and downward pressures on inflation roughly balancing out. The upward pressure from shelter and other services gradually diminishes, and the downward pressure on inflation recedes as excess supply in the economy is absorbed.

With inflation now back around the 2 percent target, governing council decided to reduce the policy rate by 50 basis points to support economic growth and keep inflation close to the middle of the 1 to 3 percent range. If the economy evolves broadly in line with our latest forecast, we expect to reduce the policy rate further.

However, the timing and pace of further reductions in the policy rate will be guided by incoming information and our assessment of its implications for the inflation outlook. We will take decisions one meeting at a time. The bank is committed to maintaining price stability for Canadians by keeping inflation close to the 2 percent target.

Monetary Policy Report—October 2024 – mpr-2024-10-23

Information note

The next scheduled date for announcing the overnight rate target is December 11, 2024. The bank will publish its next full outlook for the economy and inflation, including risks to the projection, in the MPR on January 29, 2025.