Company’s suite of predictive indices show bankruptcy fears are rising sharply even though official statistics lag and will take months to confirm

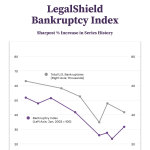

ADA, Okla.–(BUSINESS WIRE)–Released today, the July 2020 LegalShield Law Index, a suite of leading indicators of the economic and financial status of U.S. households and small business, saw its Consumer Financial Stress Index remain little changed in July, despite widespread job loss since February, as Americans awaited the outcome of negotiations to extend federal fiscal support. However, in a worrying sign, the company’s Bankruptcy Index rose for the first time in 9 months, reversing its steady downward trend in 2020 and marking the sharpest percent increase in series history. LegalShield has been measuring the demand for various legal services for nearly 16 years, collecting real-time data from consumers on those issues of greatest concern. The company’s data, therefore, often detects trends before traditional indicators and is viewed as predictive.

“For the first time in U.S. history, American consumers are facing an imminent economic collapse because of political gridlock in Washington D.C.,” said LegalShield CEO Jeff Bell. “The earlier actions of Congress and the Federal Reserve forestalled a full meltdown of the U.S. economy, but without additional economic aid now our data suggest that we are on the precipice of an epic wave of small business and personal bankruptcies. In July, total intakes – consumer inquiries into specific legal services – surpassed 90,000 for the first month since January and were at the second highest level in nearly eight years, since August 2012. We are setting new record intakes each month around landlord-tenant, billing and employment issues, showing the pain is only worsening. President Trump’s recent executive actions are helpful only in focusing attention on the problem, not in solving the plight of millions of Americans. Only Congress with the power of the purse can do that, and lawmakers need to act boldly and quickly before we spiral completely out of control.”

The LegalShield Law Index reflects the demand for legal services among the company’s provider law firms in all 50 states, and includes five sub-indices focused on consumer financial stress, housing activity, real estate, bankruptcy and foreclosure. The five sub-indices tend to lead an existing economic indicator that sheds light on the health of the U.S. economy. Highlights from July are as follows:

- The LegalShield Consumer Financial Stress Index was little changed for the month, ticking down 0.1 point from 66.5 in June to 66.4 in July. Federal efforts to mitigate the economic collapse have kept consumers afloat, but significant uncertainty remains regarding the extension of these measures.

- The LegalShield Bankruptcy Index rose (worsened) 6.9 points from 23.4 in June to 30.3 in July, the sharpest increase in series history although still below pre-pandemic levels. Meanwhile total U.S. bankruptcies eased in June and are down 31% from June 2019. However, large banks are anticipating the likelihood that things could get worse, and have set aside tens of billions of dollars in Q2 to offset impending loan losses. While consumer bankruptcies remain historically low, most signs point to an increase, and the company’s bankruptcy index is designed to provide an early warning signal.

- The LegalShield Housing Activity Index reached a new high for the third consecutive month, suggesting that housing starts should continue to improve over the coming months. The index increased 1.7 points to an all-time high of 128.4 in July. LegalShield and broader housing data suggests construction activity will continue to recover in the near- to medium-term. The NAHB/Wells Fargo Housing Market Index has followed suit, for example, surging 14 points in July with its next report scheduled for August 17.

- The LegalShield Real Estate Index improved to its highest level in 14 years, in line with the jump in existing home sales. The index increased 1.1 points in July to 107.5, the highest level since June 2006. Meanwhile, existing home sales surged a record 21% in June, as anticipated by recent movements in LegalShield data. The National Associations of Realtors will next report home sales on August 21, anticipating another strong month of activity.

- The LegalShield Foreclosure Index edged down in July, falling 1.1 points to 38.9 in July, near a historic low. Without the moratorium on evictions, however, there is evidence that foreclosure activity could spike in the coming months.

About LegalShield and IDShield

A trailblazer in the democratization of affordable access to legal protection, LegalShield is one of North America’s largest providers of online legal subscription plans covering more than 4.4 million people. Its IDShield identity theft solution for individuals and families has more than one million members. LegalShield and IDShield serve more than 141,000 businesses. In addition, over 40,000 companies offer LegalShield and IDShield plans to their employees as a voluntary benefit. Both legal and identity theft plans start for less than $25 per month. For more information about LegalShield, visit: https://www.legalshield.com/ or for more information about IDShield, visit: https://www.idshield.com/.

Contacts

Media:

Doug Donsky (ICR, Inc.)

(646) 361-1427

legalshieldpr@icrinc.com