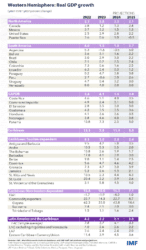

WASHINGTON, USA – After successfully weathering a series of shocks, most countries in the region are converging to their (tepid) potential. Growth is expected to moderate in late 2024 and 2025 while inflation is projected to continue easing, although gradually.

With output and inflation gaps mostly closed but monetary policy still contractionary and public finances in need of strengthening, a further rebalancing of the policy mix is necessary. Fiscal consolidation should advance without delay to rebuild buffers while protecting priority public investment and social spending. This would support the normalization of monetary policy and strengthen credibility and resilience of policy frameworks.

Most central banks are well placed to proceed with monetary easing, striking a balance between fending off the risk of reemerging price pressures and avoiding an undue economic contraction.

Medium-term growth is expected to remain close to its low historical average, reflecting long-standing, unresolved challenges – including low investment and productivity growth – and shifting demographics. Worrisomely, the ongoing reform agenda is noticeably thin and could lead to a vicious circle of low growth, social discontent, and populist policies. Avoiding this requires pressing on with reforms. Improving governance – by strengthening the rule of law, enhancing government effectiveness, and tackling crime – is a priority that cuts across all areas of growth.

Boosting capital accumulation requires improving the business environment, fostering competition, and increasing international trade. Greater and more effective public investment is also needed. Maintaining a dynamic labor force and increasing productivity requires tackling informality and making formal labor markets more flexible, including to adapt to new technologies. Increasing female labor participation can help boost the labor force and offset demographic shifts.

Closing the Gap: Labor market participation in Latin America

The expanding labor force has been an important driver of economic growth in Latin America over the last decades. However, as population growth decelerates and population ages, the contribution from demographics to growth will diminish. Increasing labor force participation can mitigate these demographic headwinds. Using microdata from several Latin American household surveys, this paper documents key patterns in labor market participation and identifies demographic groups with the potential to boost the labor force going forward.

There is significant scope to offset the demographic shift by increasing female participation, although household responsibilities remain a crucial obstacle. Implementing policies that improve the availability and affordability of childcare, eliminate asymmetries in parental benefits, and make work schedules more flexible can relax constraints to women’s labor force participation. Incentivizing the elderly to remain active longer and more effectively integrating the youth into the workforce can provide an additional boost to the labor force.

Public debt dynamics in Latin America: Time to rebuild buffers and strengthen fiscal frameworks

Understanding the drivers of public debt is paramount to assessing fiscal sustainability risks. This paper studies Latin America’s debt dynamics over the last two decades, the factors behind the buildup of debt preceding the pandemic, and their possible role going forward. Drivers of debt changed substantially, with forces that drove debt down during the commodity price boom reversing once it came to an end—growth decelerated, and public finances weakened substantially despite compliance with fiscal rules. With many of these forces still at play, and an unfavorable interest rate-growth (‘r-g’) differential, maintaining debt on a sustainable path will require strong fiscal discipline. Strengthening fiscal frameworks will be of paramount importance.

IMF Western Hemisphere October 2024