Excluding Growth in China, Sales Declined 21%

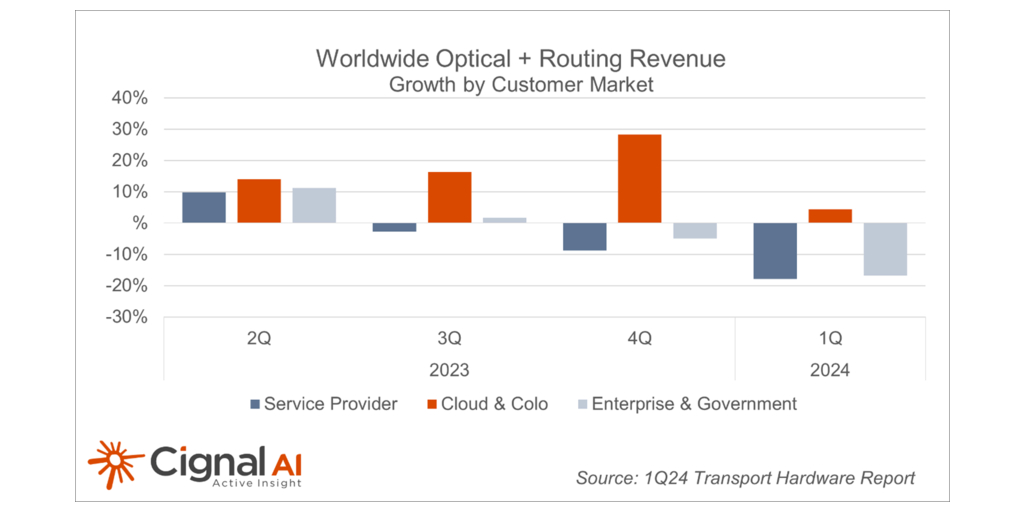

BOSTON–(BUSINESS WIRE)–There was no relief in 1Q24 for Optical and Routing Transport equipment, according to the 1Q24 Transport Hardware Report from research firm Cignal AI. While spending by cloud operators continued to grow, it was more than offset by the ongoing decline in purchasing among traditional service providers.

“Cloud Operators continue to provide the financial and technical leadership in the transport equipment market,” said Kyle Hollasch, Lead Analyst at Cignal AI. “Based on our discussions within the supply chain, we don’t expect a recovery in spending from traditional service providers until 2025, at the earliest.”

Additional 1Q24 Transport Hardware Report Findings:

- Spending in North America on Optical Transport equipment declined for the 4th straight quarter, while Routing dropped to levels last seen in 2020.

- Cloud Operator expenditures hit double digits while traditional service providers continued to cut back. Sales to Cloud & Colo operators exceeded Service Provider spending for the second consecutive quarter. Ciena remains the primary beneficiary of Cloud spending.

- Network operators in EMEA spent cautiously, apart from buildouts for cloud operators, which grew almost 50%.

- Chinese operators are upgrading long-haul WDM infrastructure, and the latest contract awards benefitted Huawei, ZTE, and Fiberhome. Routing equipment in the region remains flat.

- Now that Indian operators have completed a series of 5G related builds, spending in RoAPAC (ex-China and Japan) is in a downturn.

Live Presentation Available

Results from Cignal AI’s Transport Hardware Report are presented live each quarter by Lead Analyst Kyle Hollasch. Clients are welcome to register for a presentation on June 12th at 11 AM ET.

About the Transport Hardware Report

Cignal AI’s Transport Hardware & Markets Report is issued each quarter and examines optical and packet transport equipment revenue across all regions, customers, and equipment types. The initial analysis is based on financial results, independent research, and guidance from individual equipment companies. Hardware forecasts are reviewed and updated in the following weeks, along with spending trends by operator type.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) optical equipment, and access, aggregation, edge, and core routing equipment in six global regions. It also tracks equipment spending by end-customer market type, including traditional service provider, cloud/hyperscale, and enterprise/government network operators. Key market segments such as Compact Modular and Packet-OTN equipment as well as shipments of ROADMs are also included. Vendors in the report include Adtran, Alaxala, Ciena, Cisco, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper, Mitsubishi Electric, NEC, Nokia, Packetlight, Padtec, Ribbon, Smartoptics, Tejas, Xtera, ZTE as well as other vendors. A full report description, articles, and presentations are available on the Cignal AI website.

About Cignal AI

Cignal AI provides active and insightful market research for the networking component and equipment market and the market’s end customers. Our work blends expertise from a variety of disciplines to create a uniquely informed perspective on the evolution of networking communications.

Contacts

Contact Us/Purchase Report

Sales: sales@cignal.ai

Web: Contact us