By Casey Michel

For years, the US acted as one of the world’s leading centres for money laundering and offshore finance. Now, that reality is changing fast.

With little fanfare, the US has in the past few weeks announced or implemented new reforms across a range of sectors that traditionally lent themselves to money laundering. All of this is an outgrowth of the Biden administration’s focus on countering corruption.

The most important measure came last month, when the US finally brought its new beneficial ownership registry online. The registry will shine a light on the constellation of anonymous shell companies previously formed in the country. For years, the US enabled the creation of these shells at a far higher clip than competitors, led especially by states such as Delaware and Nevada. To take but one data point, the World Bank found in 2011 that the US formed more anonymous legal entities than 41 tax havens combined – a trajectory that has, by all appearances, only continued since.

Now, thanks to the new registry, the ability of anyone – from kleptocrats and oligarchs to cartel heads and arms traffickers – to obtain their own anonymous shell in Wilmington or Reno is no more. Those forming companies will need to identify the so-called “beneficial owners”, or face potential jail time if they wilfully avoid providing the information.

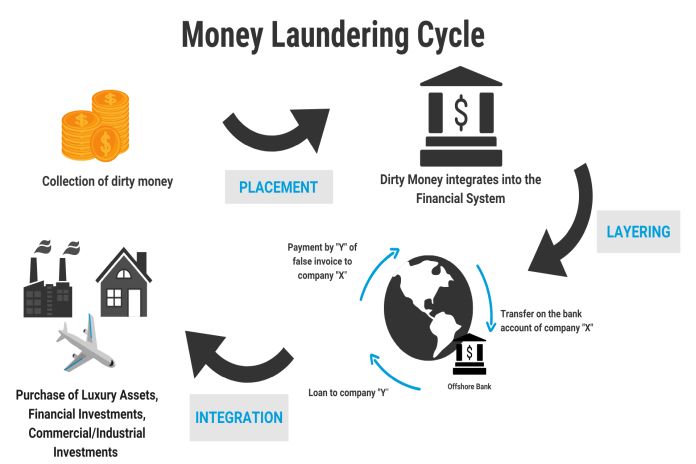

That move alone would have been laudable. After all, it’s these anonymous shells that serve as the bedrock for almost all offshore networks, helping strip identifying information from the dirty money in question.

But the administration hasn’t stopped there. Earlier this month, officials at the Treasury department’s Financial Crimes Enforcement Network announced transparency requirements for American residential real estate. For a long time, this sector has acted as a sponge for questionable finance, transforming kleptocratic wealth into stable, appreciating assets.

Those days will soon be behind us. US officials announced they would be ending a decades-long loophole that absolved real estate professionals from basic anti-money laundering checks. Now, those sealing real estate deals – including attorneys – will have to identify the people behind previously anonymous purchases.

That’s still not all. FinCEN announced a new proposed rule for the private investment sector, which has acted as an open sieve for illicit wealth. Private equity, hedge fund and venture capital markets have spent decades dodging even basic anti-money laundering checks. The sector, which has nearly doubled in size over the previous decade and is now worth tens of trillions of dollars, has in effect acted as a new bright, blinking light for the world’s worst actors to hide their wealth. A 2020 memo from the FBI pointed directly to “ever-increasing opportunities for threat actors to co-opt investment funds without being overly scrutinised”.

Now, all SEC-registered funds will have to conduct basic due diligence checks on clients, including on the sources of their wealth. It’s a minimal burden, placing the fund managers on a par with those at American banks, who’ve long had to conduct anti-money laundering checks.

Of course, there are still plenty of issues remaining. The shell company registry needs to be enforced – a lesson that Britain learned the hard way, not long ago. The real estate rules focus only on residential, rather than commercial, constructs. And the private investment requirements could be undone by a Trump administration, which would likely be far less interested in such efforts.

But those are all issues for the future. Right now, it’s worth taking a step back and acknowledging that the end of America’s role as a central vector for global money laundering is, at long last, in sight.

- Casey Michel oversees the Human Rights Foundation’s combating kleptocracy programme.

Source: US Department of the Treasury originally published in Financial Times