By BDC

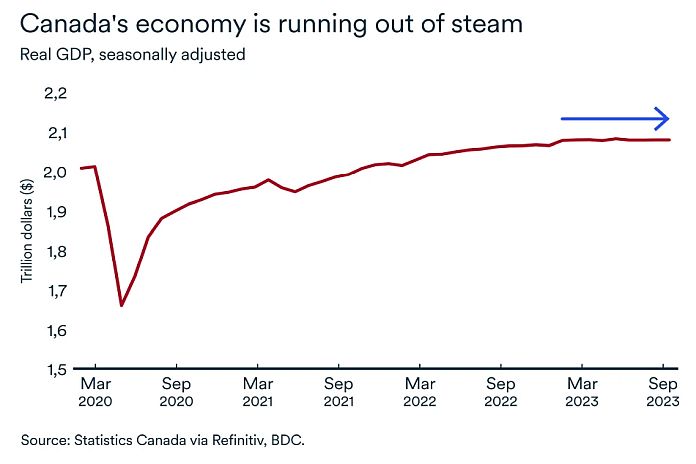

MONTREAL, Canada – Amid inflation, high interest rates, forest fires and drought, the Canadian economy continued to be stuck in neutral in August.

Monthly real GDP growth was flat (+0.0%) compared with July. The economy was saved from an even worse performance by the service industry, which remained resilient during the month.

Growth was also sluggish in September, according to preliminary data from Statistics Canada. As a result, it appears the economy was stagnant in the third quarter.

Households readjust their budgets

In addition to a decline in the agriculture and forestry sectors due to this summer’s extreme conditions, the majority of other industries retreated. Past interest rate hikes continue to slow sectors that are sensitive to rates. Pullbacks in manufacturing, retail, and accommodation and food services limited overall economic growth in August, together reducing monthly growth by 0.13 percent.

Households are cutting back on purchases that are often financed with a loan, including vehicles, household appliances and electronics.

However, in Bank of Canada’s latest survey, 24 percent of households reported they still plan to spend heavily on services (travel, entertainment events) in the next six months, a reading similar to that for the last six months.

Manufacturing goes from bad to worse

The outlook for the Canadian manufacturing sector seems to worsen with each passing month.

The purchasing managers’ index is still trending downward. After dipping below the 50 mark (which usually indicates a contraction in the sector) in May, the index has not recovered since. It hit 47.5 in September, the lowest level recorded since May 2020 at the height of the pandemic.

Purchasing activity continues to slow, with companies preferring to sell off their inventories than replenish them as a slowdown in demand takes hold.

Towards a more sustainable job market

While the Canadian economy continued to create jobs in October (+18,000) and the unemployment rate still low at 5.7 percent, pressure on the labour market eased.

The number of job vacancies fell again in August, albeit only slightly compared with July, from 698,000 to 682,400. Although this level is still high, it’s the lowest level in over two years, which should ease the competition for workers.

High economic uncertainty is causing companies to slow their hiring intentions, and workers are less likely to change jobs. The slowdown in the economy appears to be bringing the labour market into better balance, even if retirements remain high with the addition of more than 240,000 new retirees year-on-year in October.

These various factors have resulted in wage growth of 4.8 percent between October 2022 and October 2023, a slower pace than in recent months.

The impact on your business

- Although the Bank of Canada opted not to raise its key interest rate in October, rising debt payments by Canadian households will continue to slow domestic demand. This trend will gain momentum in the months ahead, as past rate hikes continue to work their way through the economy and households adjust their budgets.

- Despite the continuing strength of the labour market, households have less and less leeway to absorb interest rate hikes and price increases. They’re becoming increasingly cautious in their spending.

- Companies are also becoming more cautious. In addition to declining hiring intentions, many companies would rather sell off their current inventories than replenish their shelves. So, whether you’re dealing with consumers directly or with other companies, be prepared to feel the effect of the slowdown sooner or later.