BDC Monthly Economic Letter

The Bank of Canada raised its key rate by 25 basis points at the June meeting, and did so again on July 12, bringing the rate to 5.0 percent. Despite signs of improvement in inflation, Canada’s central bank felt that demand was still too strong in the country, and that credit conditions needed to be tightened a little further.

The rate is now expected to peak at 5.0 percent this year, meaning that the Board of Governors is done with rate hikes and that the next change in monetary policy will be a rate cut. Of course, more economic indicators will have to slow down to get to that point.

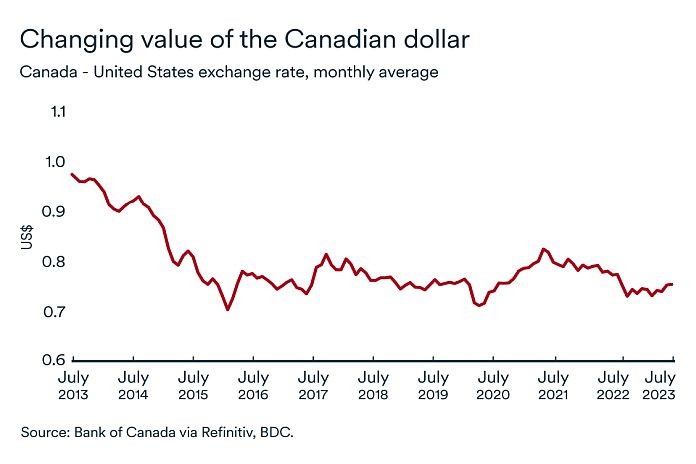

The loonie at US$0.75

The Canadian dollar has appreciated slightly recently, averaging US$0.75 in June and early July. This rebound of the Canadian currency against the US greenback is explained by the interest rate differential between the two nations.

While the Bank of Canada raised its rate in June, the Federal Reserve preferred to maintain the status quo that month. The Canadian dollar is likely to remain in this range over the coming weeks, and may even appreciate slightly further after the July rate hike.

Business confidence falls in June

In June, CFIB’s business confidence index for the coming year fell by two points. This is the first monthly decline in the index since November 2022. The index remains above the critical 50 mark, having fallen from 56.2 to 54.1. Businesses remain on edge, and recents rate hike announcement is likely to have rekindled fears of a more pronounced slowdown among many companies.

An indicator at 50 means that as many business managers expect the business environment to worsen as to improve over the next 12 months.