NEW YORK–(BUSINESS WIRE)–#KBRA–The private debt market in aviation has seen significant growth in recent years, as companies increasingly turn to alternative sources of financing to fund their operations. The public bond markets have generally been the largest source of nonbank funding for airlines, aircraft lessors, and original equipment manufacturers (OEM). However, with increased bond market volatility, private credit lenders saw the opportunity for many seasoned and new aviation issuers, given other sources of financing became more expensive and difficult to access. Such financings are generally placed in the private placement market which is particularly vibrant in the U.S., while gaining momentum in Europe, Asia, and other jurisdictions.

Higher capital charges for banks and the risk-off sentiment by public investors related to COVID-19 and its outsized impact on air travel have made both the private debt and the private placement markets especially attractive for aviation issuers. At the same time, rising demand for new and more efficient aircraft post-COVID requires access to large volume of financing even if the public bond markets are currently volatile. The flexibility and rising liquidity in the private debt markets provides a feasible solution for the uncertainty of the public bond markets, which are often more expensive to execute and require burdensome regulatory and disclosure requirements.

While a large volume of such issuances may remain on the sponsoring entity’s balance sheets for fee and interest income generation, a growing portion are offered as debt instruments taken up by private investment portfolios within pension funds and/or insurance companies. Other sources of funds can come from equity and debt interest from limited partners (LP) or separately managed accounts at asset management firms. Private placement investments often do not have the volatility of the public markets and tend to cater to buy-and-hold investors with a long-term view of credit quality, which is especially important for longer life aviation assets. Moreover, they are willing to spend the time and work on complex transactions with tailored solutions for borrowers.

Airlines, aircraft lessors, and OEMs have come to highly appreciate the flexibility that private placements can offer in terms of size, maturities, drawdown terms, and collateral composition. This trend began shortly after the global financial crisis (GFC), when issuers across the aviation industry focused on diversifying funding sources. In addition, private placements became a critical source of capital not only for small to midsize issuers, but also for established public issuers in aviation. The ability to structure more bespoke transactions or finance nontraditional portfolios such as older aircraft, freighters, aircraft engines, and business jet aircraft has also been instrumental for such issuers. Private financing backed by intangible assets such as routes, slots and gates, as well as loyalty programs and brands have also become common.

Pricing for private offerings tend to be wider than bank lending or the public markets. But lower execution risk and ability to match fund liabilities with smaller issuance proceeds or longer-term fixed rate assets are increasingly valuable, providing investors with the right balance between risk and return. When combined with bespoke structural protections, this makes them an attractive asset type for the private placement market.

Key Takeaways

- Since the aftermath of the GFC, the private debt market has provided a consistent and competitive source of funding across the aviation industry, often complementing bank and public funding sources.

- Private placement debt offers a more advantageous execution for midsize aviation issuers seeking right-sized offerings that match more granular funding needs with greater structural flexibility.

- Private offerings by the nonbank private debt issuers have key added benefits for investors including a premium yield compared to public markets, credit and geographic diversification, bespoke structural downside protections, and good asset-liability matching via strong call protections.

- Given the ongoing volatility of the public debt markets and ample liquidity in private credit, KBRA expects private placement investments in aviation to continue as a growing source of funding for aviation issuers.

Following a period of strong issuance from 2020 through mid-2022, the market for private placements in aviation slowed in early 2022, reflecting the uncertainty and disruption driven by rising interest rates, inflation, and geopolitical tensions. That said, other than bank lending, the private placement market was the only source of funding for issuers in need of financing during the year, until Air Lease Corporation opened the public markets with its issuance of $700 million five-year senior unsecured notes on December 5, 2022. Notably, the private credit market was highly supported by asset managers and/or private equity firms to fill the void left by bank lending and the public markets. So far, private lenders in conjunction with pension funds and separately managed accounts have been active in structuring and placing such financings in the private placement markets, mainly in the U.S. KBRA observes that the global private placement market is also expanding, especially in Europe, where investors have been increasingly participating in private issuance both by U.S. and non-U.S. firms.

Private Placement in Aviation

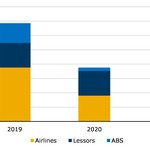

Aviation-related issuance across the debt markets slowed in 2022 as borrowing costs surged due to rising interest rates as well as wider credit spreads. The reduced capital markets activity also represents a degree of normalization following strong issuance during the pandemic, when over $120 billion was raised by airlines and lessors globally to back up liquidity. Nonetheless, airlines and aircraft lessors have been actively issuing in the private placement market and in some instances completing complex transactions. Issuances spanned a range of categories beyond traditional airlines and lessors but also included business jet operators and transactions backed by engines. KBRA observes that there have been more issuances from airlines than lessors in the private placement market. Large operating lessors typically utilize the public unsecured markets or banks for the bulk of their funding needs; however, they sometimes use the public ABS markets for sale of asset portfolios to other investors while maintaining the servicing rights. Conversely, the smaller lessors, or those structured as funds, use the ABS market as their main source of funding.

In March 2022, Sun Country Airlines issued a $188.2 million private enhanced equipment trust certificate (EETC) using 13 midlife Boeing 737-800s as collateral. The two-tranche transaction has a weighted average interest rate of 5.06% with class A certificates maturing in 2031, while class B certificates mature in 2029. In April 2022, Iberia Airlines placed a $461 million private placement sustainability-linked EETC backed by two Airbus A350s and three A320neos. In July 2022, Air France Airlines completed a unique €500 million secured transaction backed by a pool of aircraft engines. And in October 2022, British Airways priced a $299 million private placement structured as a EETC involving a JOLCO equity structure and secured against two A320neos and two A350-1000s.

The widening appeal of private placements also allowed business jet operators to raise $557 million in 2022 and the $1.3 billion issuance completed in 2021. In August 2022, Vista Jet secured a $288 million EETC across two tranches backed by a portion of Vista’s fleet, with class A tranche maturing in 2030 and class B in 2029. Private jet charter company Wheels Up placed a $270 million private EETC issuance in October, secured by 134 of its aircraft fleet.

Private placements by lessors were largely limited to lease-backed transactions. Notably, a $303.7 million private placement ABS transaction, MAST 2022-1 Ltd & MAST 2022-1 USA LLC, was completed in late 2022 by Airborne Capital. The transaction was backed by a portfolio of 15 narrowbody aircraft, including two 737 MAX 8s, two A320neos, six A320-200s, and five 737-800NGs.

The typical use of private placement proceeds across the sector is like those of public bonds, including refinancing debt, fleet expansion, and recapitalization programs. Further, transactions range between less than $100 million to over $1 billion. KBRA estimates that the total outstanding market for aviation-related private placements is approximately $30 billion-$40 billion, representing a relatively small but growing subset of the overall $1.2 trillion private credit industry.1 In our observation, the private investor universe across aviation comprises approximately 20-30 institutional investors, life insurance companies, asset managers and pension plans, and increasingly large private debt sponsors. Most of these firms have an established track record of providing capital across the sector, although new investors have recently shown increased interest, given the attractive yield and good lender protections. Private placements offer investors the ability to diversify and generate higher yields while benefiting from various structural protections. Private placement holders also often build relationships with airlines and lessors at the time of the deal and maintain those relationships after purchase, which can be important if covenants are triggered, or potential restructurings are involved.

Aviation Issuers in the Private Placement Market

Over the past decade, aviation issuers across the private placement market have evolved from small and midsize airlines and lessors seeking to raise incremental capital to supplement bank financing to many large airlines and global lessors choosing to access the private placement market as means of permanent funding source. Since the pandemic outbreak, the private placement market was a consistent and reliable source of much needed capital that offered flexibility to allow airlines to raise capital against their fleets and intangible assets. Some notable and unique transactions included American Airlines’ $1.2 billion placement secured by slots in New York LaGuardia and Ronald Reagan Washington National airports, as well as certain brand and trademark assets. Also in 2020, Nordic Aviation Capital priced the largest unsecured lessor private placement, at $858.8 million with staggered maturities. Private placement investors have demonstrated a growing appetite for aviation credit that have historically generated higher total returns versus holding a basket of similarly rated public unsecured bonds and EETCs. This is achieved by several factors including:

Structural Protections

Financial maintenance covenant protections—a key differentiator between public and private issuance—provide downside protection from financial, collateral, and event risks. Covenants also ensure seniority in the capital structure which, in the case of default, typically results in higher recoveries for private placement holders relative to public debt holders. From KBRA’s observation, covenants at the corporate level typically require maintenance of certain leverage threshold (i.e., debt/EBITDA), minimum liquidity, and minimum asset coverage ratios. For secured transactions, covenants may include loan-to-value floors and restrictions on asset sales and substitutions. Covenant violations can trigger default and/or compensation to bondholders through waiver or amendment fees.

Yield Enhancement

KBRA has observed that private placements provide up to 50 basis points of additional spread relative to public bonds. The incremental yield for private placements compensated bondholders for the lack of liquidity in the secondary markets.

Credit and Geographic Diversification

Many private placement issuers in the aviation sector are not large enough to issue debt in the public debt markets, providing potential investors with additional portfolio diversification. Types of aviation issuers accessing the private placement market continues to grow, ranging from well-seasoned issuers with long issuance track record to small new airlines and lessors with issuances ranging from small simple transactions to more complex issuances. We have also observed a trend of airlines layering in subordinated tranches class B and class C certificates via the private placement market to the existing public EETCs.

The private placement market for aviation assets is considerably smaller than the public or bank markets, and the potential for resale can be limited to small, distressed transactions. Therefore, private placement investors tend to have the necessary expertise to perform independent credit risk assessment (especially for large bespoke transactions), underwrite covenant packages, complete legal jurisdiction review, and are capable of potentially completing asset repossession and liquidation. For these reasons, private investors generally demand higher returns on such bespoke financings.

Strong Call Protection

A common feature of private placements, especially in times of interest rate volatility, is call protection, which allows issuers to call bonds only with Make-Whole provisions for a specified period, which protects noteholders cash flow against reinvestment risk.

Ability to Negotiate Amendments

Private placements can be offered by both investment banks or through bilaterally negotiated placements directly between issuers and investors. Deep and extensive relationships are common across the sector, ensuring stable capital flow and transaction performance, especially during times of periodic stress common in the aviation industry. For example, through the pandemic, a number of issuers were able to negotiate favorable amendments with the noteholders to include interest-only periods, debt extensions, or power by the hour arrangements to help them prevent defaults and preserve needed liquidity in return for coupon bumps, larger reserve accounts, and other compensations.

Since the outbreak of the pandemic, private placements across the aviation sector have increased significantly, with institutional investors providing greater amount of capital to companies seeking to borrow capital at increasingly flexible and bespoke terms. In turn, these aviation placements offer attractive characteristics to investors, including potential for higher yield and diversification versus comparable public issuance. Given the appeal and the current debt market volatility, KBRA expect private placement markets to continue as sources of debt, which is a good source of capital for airlines and aircraft lessors alike.

Conclusion

Private placement markets continue to gain traction within the aviation industry, offering consistent and flexible funding to meet the financial needs of both the issuers and investors. Private placements’ ability to allow match funding of the size and timing of sources and uses often backed by unique collateral is attracting both new and seasoned aviation issuers of various sizes. KBRA believes that despite the dramatic bond market volatility, aviation issuers will continue to explore a variety of alternative funding through the private placement market to boost certainty of execution, raise liquidity, and fund new aircraft acquisitions, or to fund the growth of other aviation assets on their balance sheets.

Related Reports

- Latin American Aviation Market Poised for Strong Growth

- Aircraft Manufacturing Trends—Travel Demand Underpins Recovery

- Aviation ABS: Insurance Recoveries Suffer Major Delays

- Regional Aircraft: Opportunity in a Recovering and Evolving Market

- Russia’s Invasion of Ukraine: An Unwelcome Hit to Aircraft Leasing and Aviation

© Copyright 2023, Kroll Bond Rating Agency, LLC and/or its affiliates and licensors (together, “KBRA”). All rights reserved. All information contained herein is proprietary to KBRA and is protected by copyright and other intellectual property law, and none of such information may be copied or otherwise reproduced, further transmitted, redistributed, repackaged or resold, in whole or in part, by any person, without KBRA’s prior express written consent. Information, including any ratings, is licensed by KBRA under these conditions. Misappropriation or misuse of KBRA information may cause serious damage to KBRA for which money damages may not constitute a sufficient remedy; KBRA shall have the right to obtain an injunction or other equitable relief in addition to any other remedies. The statements contained herein are based solely upon the opinions of KBRA and the data and information available to the authors at the time of publication. All information contained herein is obtained by KBRA from sources believed by it to be accurate and reliable; however, all information, including any ratings, is provided “AS IS”. No warranty, express or implied, as to the accuracy, timeliness, completeness, merchantability, or fitness for any particular purpose of any rating or other opinion or information is given or made by KBRA. Under no circumstances shall KBRA have any liability resulting from the use of any such information, including without limitation, for any indirect, special, consequential, incidental or compensatory damages whatsoever (including without limitation, loss of profits, revenue or goodwill), even if KBRA is advised of the possibility of such damages. The credit ratings, if any, and analysis constituting part of the information contained herein are, and must be construed solely as, statements of opinion and not statements of fact or recommendations to purchase, sell or hold any securities. KBRA receives compensation for its rating activities from issuers, insurers, guarantors and/or underwriters of debt securities for assigning ratings and from subscribers to its website. Please read KBRA’s full disclaimers and terms of use at www.kbra.com.

1 KBRA Insight on Private Credit: Well Positioned to Navigate the Looming Storm

Contacts

Boris Alishayev, Senior Director

+1 (646) 731-2484

boris.alishayev@kbra.com

Marjan Riggi, Senior Managing Director

+1 (646) 731-2354

marjan.riggi@kbra.com

Media Contact

Adam Tempkin, Director of Communications

+1 (646) 731-1347

adam.tempkin@kbra.com