By Andrea Deghi, Fabio Natalucci, Mahvash S. Qureshi

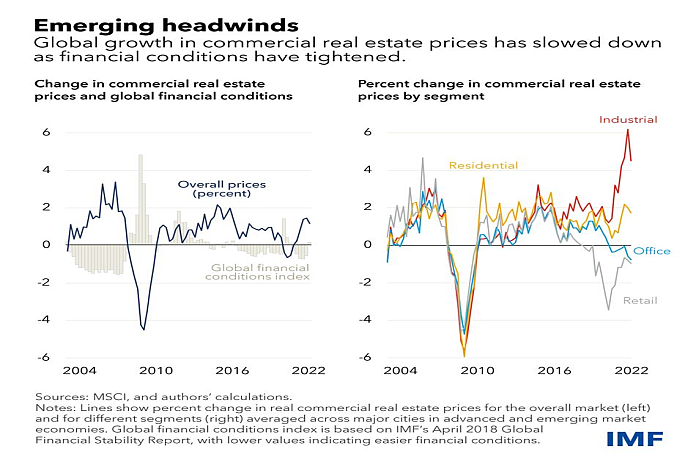

After taking a hit at the onset of the pandemic, the commercial real estate sector, properties primarily owned for investment purposes has been on the mend. Prices of industrial and residential properties have surged globally since the end of 2020, while the worst-affected retail and office segments have shown some signs of stabilization.

The momentum, however, seems to be losing steam as global financial conditions have tightened this year as central banks shift to hiking interest rates. As our Chart of the Week shows, property prices in the industrial and residential segments have, on average, experienced a deceleration across regions in recent months. At the same time, the depreciation in retail and office property prices has increased.

Tighter financial conditions tend to have a direct impact on commercial property prices by making it more expensive for investors to finance new deals or refinance existing loans, thereby lowering investment in the sector. They could also have an indirect impact on the sector by slowing economic activity, reducing demand for commercial property such as shops, restaurants, and industrial buildings.

In a recent analysis, we find that financial conditions are indeed an important driver of commercial real estate prices, and they help to explain the divergent performance of the sector across regions during the pandemic.

In general, economies with easier financial conditions (that is, lower real interest rates and other market conditions that make it easier to obtain financing) saw a smaller decline in commercial property prices during the pandemic and a faster recovery. Commercial property prices have also been higher in countries which implemented relatively less stringent public containment measures to control the spread of the virus, rolled out larger fiscal support packages, and have a higher vaccination rate.

A sharp tightening in financial conditions could thus put the commercial real estate sector under renewed pressure, especially in regions where economic growth prospects are weak and if stringent containment measures need to be put in place to curb new waves of infections.

Our analysis also suggests that trends catalyzed by the pandemic, such as working from home and e-commerce, have an impact on commercial real estate prices.

Increased teleworking, for example, tends to reduce demand for office space, while e-commerce adversely affects the price of retail real estate as consumers shop online. As considerable uncertainty surrounds the future pace and extent of such structural shifts, tighter financial conditions could compound these effects and exacerbate downward price pressures in the affected segments.

Disruptions in the commercial real estate market could in turn potentially threaten financial stability through the connectedness of the sector with the financial system and the broader macroeconomy. Continued vigilance is warranted on the part of financial supervisors to mitigate such risks.

To ensure banking-sector resilience, stress-testing large declines in commercial real estate prices should be conducted to inform decisions regarding the adequacy of capital buffers for commercial real estate exposures. Banks’ commercial real estate valuation assumptions should also be reviewed to ensure that provisions are adequate. In regions where nonbank financial institutions are important players in commercial real estate funding markets, efforts should focus on broadening the reach of macroprudential policy to cover these institutions to mitigate systemic risks.

![]()