– Economic growth shows near-term resilience amid persistent challenges

The global economy continues to gradually recover from the pandemic and Russia’s invasion of Ukraine. In the near term, the signs of progress are undeniable.

The COVID-19 health crisis is officially over, and supply-chain disruptions have returned to pre-pandemic levels. Economic activity in the first quarter of the year proved resilient, despite the challenging environment, amid surprisingly strong labor markets. Energy and food prices have come down sharply from their war-induced peaks, allowing global inflation pressures to ease faster than expected. And financial instability following the March banking turmoil remains contained thanks to forceful action by the US and Swiss authorities.

Yet many challenges still cloud the horizon, and it is too early to celebrate.

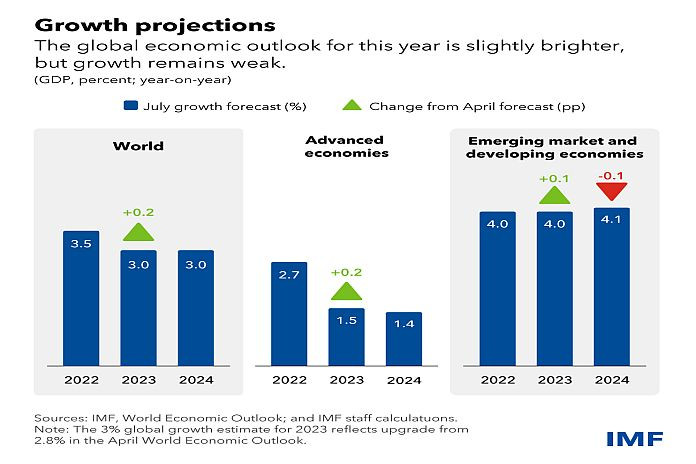

Under our baseline forecast growth will slow from last year’s 3.5 percent to 3 percent this year and next, a 0.2 percentage points upgrade for 2023 from our April projections. Global inflation is projected to decline from 8.7 percent last year to 6.8 percent this year, a 0.2 percentage point downward revision, and 5.2 percent in 2024.

The slowdown is concentrated in advanced economies, where growth will fall from 2.7 percent in 2022 to 1.5 percent this year and remain subdued at 1.4 percent next year. The euro area, still reeling from last year’s sharp spike in gas prices caused by the war, is set to decelerate sharply.

By contrast, growth in emerging markets and developing economies is still expected to pick-up with year-on-year growth accelerating from 3.1 percent in 2022 to 4.1 percent this year and next.

This average, however, masks significant differences between countries, with emerging and developing Asia growing strongly at 5.3 percent this year, while many commodity producers will suffer from a decline in export revenues.

Risks

Stronger growth and lower inflation than expected are welcome news, suggesting the global economy is headed in the right direction. Yet, while some adverse risks have moderated, the balance remains tilted to the downside.

First, signs are growing that global activity is losing momentum. The global tightening of monetary policy has brought policy rates into contractionary territory. This has started to weigh on activity, slowing the growth of credit to the non-financial sector, increasing households’ and firms’ interest payments, and putting pressure on real estate markets. In the United States, excess savings from the pandemic-related transfers, which helped households weather the cost-of-living crisis and tighter credit conditions, are all but depleted. In China, the recovery following the re-opening of its economy shows signs of losing steam amid continued concerns about the property sector, with implications for the global economy.

Second, core inflation, which excludes energy and food prices, remains well above central banks’ targets, and is expected to decline gradually from 6 percent this year to 4.7 percent in 2024, a 0.4 percentage points upward revision. More worrisome, core inflation in advanced economies is expected to remain unchanged at a 5.1 percent annual average rate this year, before declining to 3.1 percent in 2024. Clearly, the battle against inflation is not yet won.

Key to inflation’s persistence will be labor market developments and wage-profit dynamics. Labor markets remain a particularly bright spot, with unemployment rates below, and employment levels above, their pre-COVID levels in many economies. Overall wage inflation has increased but remains behind price inflation in most countries. The reason is simple and has little to do with so-called ”greedflation”: prices adjust upward faster than wages when nominal demand far exceeds what the economy can produce. As a result, real wages have declined, by about 3.8 percent between the first quarter of 2022 and 2023 for advanced and large emerging market economies.

Lower real wages translate to reduced labor costs. This may explain part of the strength of the labor market despite slowing growth. But in many countries, the observed increase in employment goes beyond what the decline in labor costs would suggest. It is fair to say that the reasons are not fully understood.

If labor markets remain strong, we should expect and welcome real wages recovering lost ground. This means nominal wage growth will remain strong for a while even as price inflation declines. Indeed, the gap between the two has started to close. Because average firms’ profit margins have grown robustly in the last two years, I remain confident that there is room to accommodate the rebound in real wages without triggering a wage-price spiral. With inflation expectations well-anchored in major economies, and the economy slowing, market pressures should help contain the pass-through from labor costs to prices.

These labor market developments matter enormously. In the near term, should economic conditions deteriorate, the risk is that firms might reverse course and sharply scale down employment. Separately, the strong recovery in employment, coupled with only modest increases in output, indicates that labor productivity the amount of output per hour worked has declined. Should this trend persist, this would not bode well for medium-term growth.

Despite monetary policy tightening and the slowdown in bank lending, financial conditions have eased since the banking stress in March. Equity market valuations surged, especially in the artificial intelligence segment of the tech sector. The dollar depreciated further, driven by market expectations of a more benign path for US interest rates and stronger risk appetite, providing some relief to emerging and developing countries. Going forward, there is a danger of a sharp repricing should inflation surprise to the upside or global risk appetite deteriorate causing a flight toward dollar-safe assets, higher borrowing costs and increased debt distress.

Policies

Hopefully, with inflation starting to recede, we have entered the final stage of the inflationary cycle that started in 2021. But hope is not a policy, and the touchdown may prove quite tricky to execute. Risks to inflation are now more balanced and most major economies are less likely to need additional outsized increases in policy rates. Rates have already peaked in some Latin American economies. Yet, it is critical to avoid easing rates prematurely, that is, until underlying inflation shows clear and sustained signs of cooling. We are not there yet. All the while, central banks should continue to monitor the financial system and stand ready to use their other tools to maintain financial stability.

After years of heavy fiscal support in many countries, it is now time to gradually restore fiscal buffers, and put debt dynamics on a more sustainable footing. This will help to safeguard financial stability and to reinforce the overall credibility of the disinflation strategy. This is not a call for generalized austerity: the pace and composition of this fiscal consolidation should be mindful of the strength of private demand, while protecting the most vulnerable. Yet, some consolidation measures seem entirely appropriate. For instance, with energy prices back to their pre-pandemic levels, many fiscal measures, such as energy subsidies, should be phased out.

Fiscal space is also key to implement many needed structural reforms, especially in emerging and developing economies. This is especially important since prospects for medium-term growth in income per capita have dimmed over the past decade. The slowdown is sharper for low- and middle-income economies relative to high-income ones.

In other words, prospects for catching up to higher living standards have diminished markedly. At the same time, elevated debt levels are preventing many low-income and frontier economies from making the investments they need to grow faster, with high risks of debt distress in many places. Recent progress toward debt resolution for Zambia is encouraging, but faster progress for other highly indebted countries is urgently needed.

Some of the slowdowns in growth reflects the spillover of harmful policies. The rise of geoeconomic fragmentation with the global economy splitting into rival blocs, will most harm emerging and developing economies that are more reliant on an integrated global economy, direct investment, and technology transfers. Insufficient progress on the climate transition will leave poorer countries more exposed to increasingly severe climate shocks and rising temperatures, even as they account for a small fraction of global emissions. On all these issues, multilateral cooperation remains the best way to ensure a safe and prosperous economy for all.