-

-

- CariBBB+ (Regional Scale Foreign Currency)

- CariBBB+ (Regional Scale Local Currency)

-

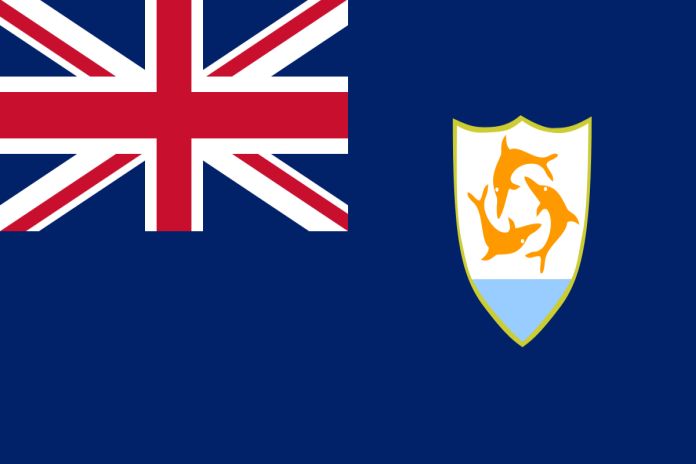

The VALLEY, Anguilla – Caribbean Information and Credit Rating Services Limited (CariCRIS) has reaffirmed the ratings of CariBBB+ (Foreign and Local Currency) on the regional rating scale to the notional debt of USD 25 million of the Government of Anguilla (GOA).

These ratings include a 6-notch uplift for the high likelihood of support from the United Kingdom (UK). The notched-up regional scale ratings indicate that the level of creditworthiness of this obligation, adjudged in relation to other obligations in the Caribbean is adequate.

CariCRIS has also maintained a stable outlook on the ratings. The stable outlook is based on the strong fiscal and debt management support from the United Kingdom, notwithstanding the impacts following the coronavirus (COVID-19) pandemic on the tourism industry and economic activity.

The ratings are driven by the following strengths:

- Support from the UK Government as an Overseas Territory;

- The rebuilding of the economy and infrastructure continues following the passage of hurricane Irma, although temporarily derailed due to COVID- 19, and:

- Fiscal performance remains carefully managed to control debt accumulation.

These rating strengths are tempered by the following factors:

(1) Anguilla is a small island developing State with significant capacity constraints,

(2) continued breach of debt management benchmarks and increased debt servicing requirements, notwithstanding improvements, and;

(3) Anguilla’s financial sector is characterized by high non-performing loans and low capitalization.

Rating sensitivity factors

Factors that could lead to an improvement in the Ratings and/or Outlook include:

- Real GDP growth in excess of 5 percent over pre-hurricane level of GDP for at least 2 years;

- A fiscal surplus of more than 5 percent of GDP recorded for at least two consecutive fiscal periods, with no breaches of debt metrics;

- Meaningful diversification of the economy.

Factors that could lead to a lowering of the ratings and/or Outlook include:

- An increase in debt to GDP ratio to above 70 percent;

- A significant decline in grant support without other compensating revenues;

- A change in the country’s status as a British Overseas Territory or a material change in the level of support rendered to Anguilla;

- The banking sector’s capitalization ratio falling below 8 percent.