By FocusEconomics Insights

CARACAS, Venezuela — In an attempt to simplify daily transactions, the Central Bank of Venezuela decided to chop six zeros off its national currency on October 1. The move marked the third rebasing of the Bolívar since 2008 as political turmoil over the past several years and US sanctions imposed in 2019 continue to batter economic output and cause hyperinflation.

Referred to as the Digital Bolívar, the new version of the national currency is expected to have a minimal impact on taming price pressures and supporting the economic recovery, as the majority of everyday transactions are already settled in US dollars. This informal dollarization has helped to temper the rise in prices: Inflation has gradually eased since March, falling to the lowest level in nearly a year in September. Therefore, the Digital Bolívar will mainly serve to boost the digitalization of the economy and simplify tax collection and accounting procedures. The physical usage of the new Bolívar may help to facilitate transactions for some daily purchases which still use the currency, such as public transport and subsidized gasoline, likely providing marginal productivity gains along the way.

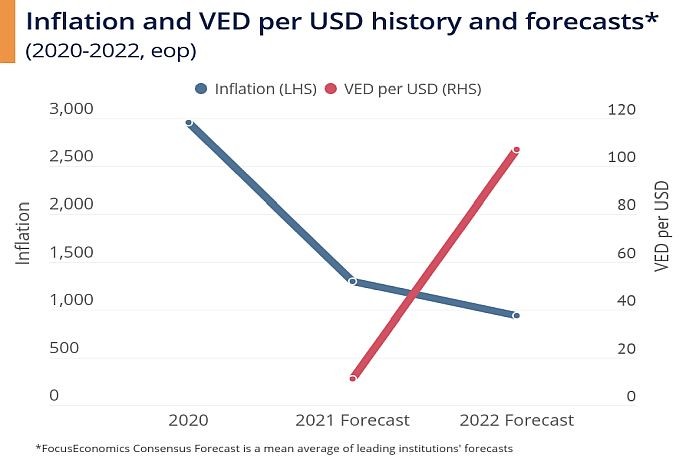

Looking ahead, our panel of analysts expects inflationary pressures to ease notably this year and in 2022, but to remain excruciatingly high nonetheless. Moreover, without a concrete economic stabilization plan in place amid ongoing geopolitical tensions with the West, the Digital Bolívar is seen losing its value against the USD at a rapid pace.

Insights from our analyst network

Commenting on the latest currency move, analysts at the EIU noted: “Although the measure is ostensibly part of the BCV’s pivot to digitization, the authorities have confirmed that they will still continue to issue fiat money. In our view, the redenomination is largely cosmetic; although it will help to simplify bookkeeping for a while, it will not fundamentally engender confidence in the Bolívar, and large-scale debt monetization will continue to erode the value of the currency. Consequently, local adoption of the US dollar will continue apace.”

Moreover, reflecting on the current trend and short-term outlook for inflation, Alberto J. Rojas at Credit Suisse said: “High inflation will likely persist, despite the government’s decision to remove six zeroes from the Bolívar starting in October. We have long noted that Bolívar inflation no longer has the impact in real activity it had in the past. However, as a reference, we are revising our 2021 year-end annual headline inflation forecast to 915 percent, from a previous estimate of 1,950 percent; for year-end 2022, our inflation forecast is of about 800 percent. We think that a reduction in scarcity levels might be aiding in decelerating price pressures at the margin.”